Going over a lot of my old college papers today. Here is one snippet I found. Funny how things turn out. One might think "maybe I should have prepared better." What ever the case me be, always keep digital copies and backups of your old papers and files. Physical paper can burn, get lost or stolen, while it's fun to have ( and I have loads of it) try converting your texts to digital to store for safe keeping. Here is a post about

how to help prevent data loss.

This is a half of a paper I submitted to my professor on the FED and

monetary policy. References are at the bottom.

(original response)

|

|

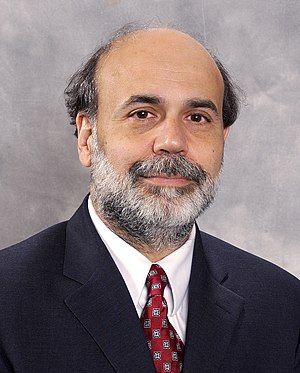

| Ben Bernanke, chairman of the Board of Governors, The Federal Reserve Board, USA. (Photo credit: Wikipedia) |

There are three tools of monetary policy that the Federal Reserve controls. These three tools are operations of the open market, discount rates, and the requirements of the reserve. The Federal Open Market Committee is charged with the open market functions, while the Board of Governors of the Federal Reserve System is charged with discount rates and requirements of the reserve. “Changes in the federal funds rate trigger a chain of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and, ultimately, a range of economic variables, including employment, output, and prices of goods and services” (Board of Governors of the Federal Reserve System).

The functions of this system was effective on some level, however the open market did cause dramatic fluctuations that caused an enormous economic downturn in recent years. As the article states, changes in federal monies set into motion a “chain of events” that significantly impact other parts of the economy, including short and long term interest rates, credit, employment, etc. The changes that were allowed freedom caused detrimental outcomes in the American economy which has resulted in the current situation we are in.

(new addition)

In regards to the Press Release dated 4/28/10, it appears as though technological and household spending is increasing. However there is a decrease in employment, pay raises, and investments in businesses. By the Federal Reserve closing out all but one of their special liquidity facilities it raised many questions about the depth of the current economic status. These special facilities are designed to assist businesses during economic crisis. A logical conclusion would be that since these facilities were created and designed to assist during the economic downturn, the act of closing all but one must indicate that the economy is on the mend and is improving significantly. The remaining special liquidity facility is scheduled to close on 6/30/10. Many individuals supported this landmark event, however there were still several who believed it was far too soon to believe the economy was on a destined path to recovery.

References:

Board of Governors of the Federal Reserve System. “Federal Open Market Committee.”

January 27, 2010. Internet: http://www.federalreserve.gov/monetarypolicy/ fomc.htm.

Collinge, Robert A. & Ronald M. Ayers. Economics By Design: Survey & Issues, 3rd Ed.

New Jersey: Pearson Prentice Hall, 2004.

|

|

| The Federal Reserve: The Biggest Scam In History (Photo credit: CityGypsy11) |

No comments:

Post a Comment